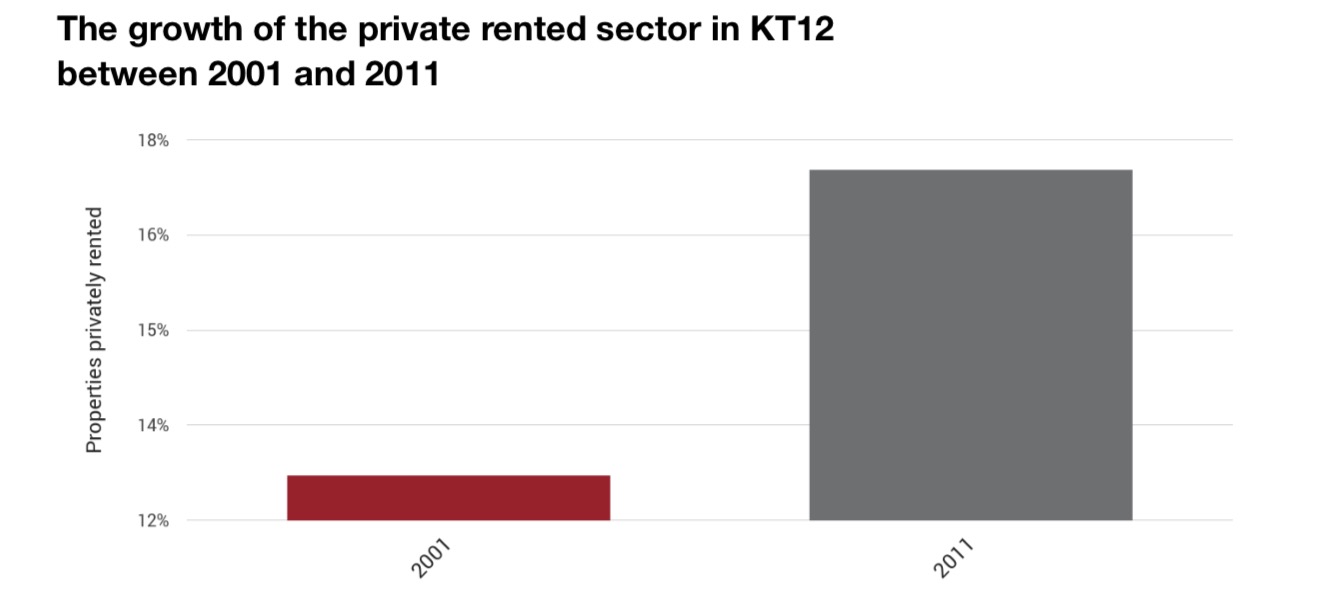

The PRS (Private Rental Sector) in the UK has grown considerably in both size and importance over the last five years and is now worth a staggering £1.29 trillion. To contextualise, that is 1.29 million stacks of pound coins, with each stack being a million coins high. The PRS now makes up 18% of the housing stock in England alone and is expected to rise to more than a third by 2032.

Because of this rampant growth, it is no surprise to see that 17.5% of homes in KT12 are privately rented, which is encouraging for private landlords and would-be investors. Even homeowners have something to think about, as they may be tempted to turn the family home into a source of income, or indeed use their pension pot to become a landlord.

A decade ago, buying a home was a very different experience. Post-credit crunch the landscape in KT12 has changed, with many younger people unable to buy their own homes due to house price growth outpacing wages. This has made it both logical and practical for many people to rent, choosing between renting privately or using the options available from the local housing association.

10 years ago, of the 12,640 households in KT12, around 10,910 were owner-occupied. Today the number of households in KT12 has risen to 13,200, with the number of owner-occupied properties falling to 10,540. In 2001, only 1,610 properties were rented by private tenants compared to 2011’s figure of 2,320 — an increase of 44%. Long gone are the days when tenants viewed rented accommodation as a stopgap; today many renters are in it for the long haul, often taking initial two-year contracts and sometimes staying for up to five years or longer.

While this is ultimately good news for private landlords wanting to minimise void periods, it also means that tenants have higher expectations and are more discerning about their rented homes. They are inclined to pay that little bit extra to get exactly what they desire from a home, and landlords will need to ensure their properties are in the best condition possible if they are going to maximise their return.

There is certainly a benefit for landlords who run their property portfolios as a business; the attention to detail that comes from this approach will help mitigate the expected refurbishment losses from reduced tax relief in the years ahead. The reduction in tax relief from 45% to 20% will affect buy-to-let landlord investors over the next few years and probably put some people off becoming landlords. However, the ones who are savvy and make the most informed decisions will continue to prosper in the PRS. Looking ahead, we expect the recent changes to stamp duty on second homes to create a small increase in the proportion of owner-occupiers relative to the PRS. But the sky-high level of demand for houses in KT12 means the capital value of properties is set to remain strong.

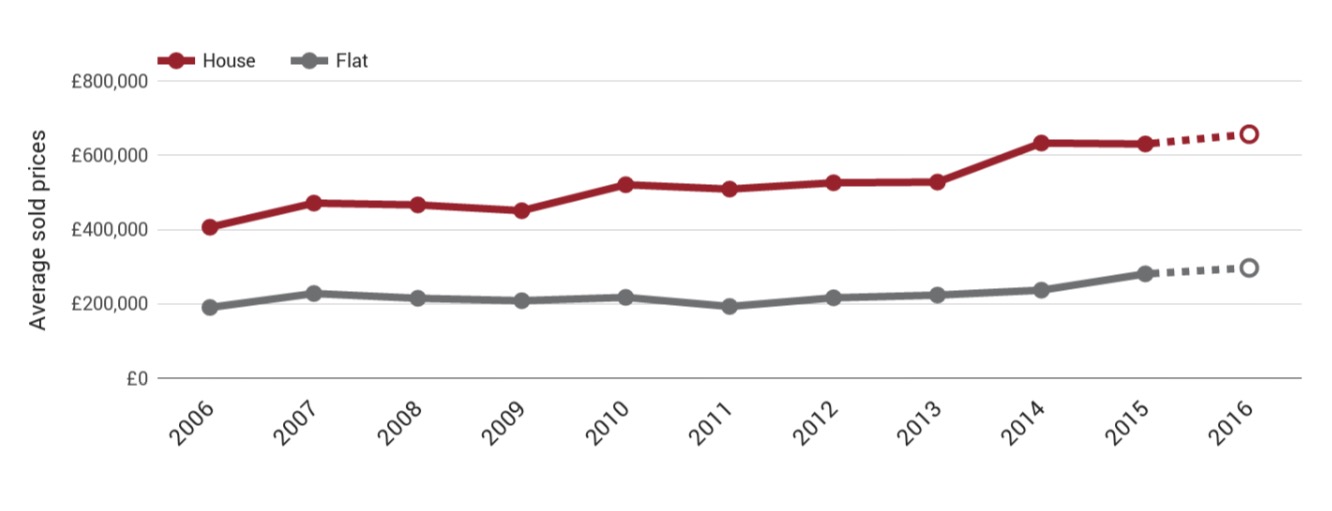

Long-term property price review in KT12

It is the time of year when we can look at how property prices in 2016 fared in comparison to the decade preceding it. With property price data still to come through for the end of the year, our estimates paint a promising picture. The average flat price increased by 5.7% to £296,700 and the average house price increased by 4.2% to £656,500 versus 2015 prices.

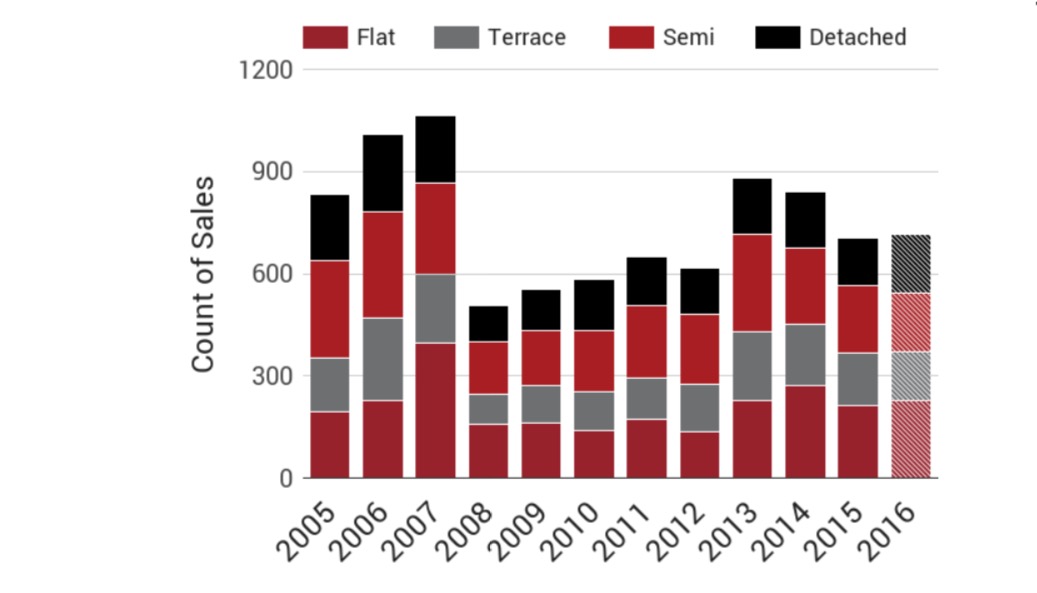

Overview of the KT12 market structure

The total number of property transactions and the mix of properties are strong indicators of the buoyancy of the local property market in the area. The adjacent chart gives an indication of the changing market structure in KT12. We estimate that 227 flats, 144 terraces, 173 semis and 170 detached properties were sold in 2016.

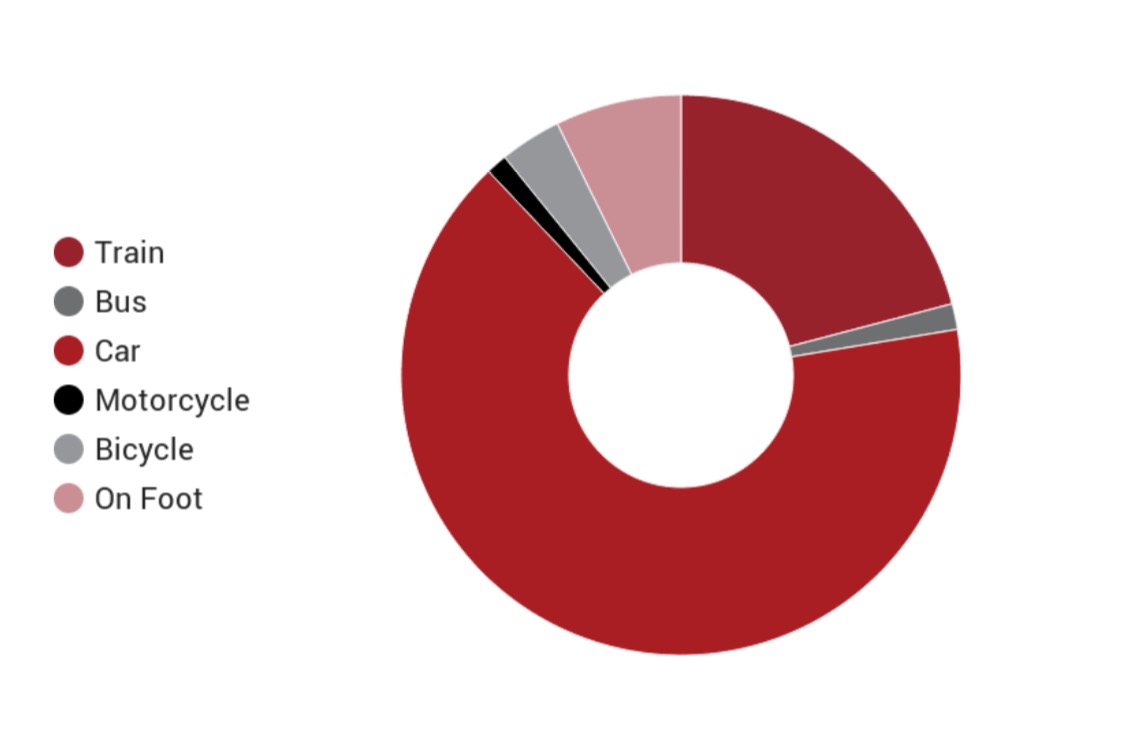

How do residents in KT12 get to work?

An analysis of commuting preferences in KT12 shows that the majority of people use a car (65.6%). This is followed by train (20.9%), and then on foot (7.3%). It will be interesting to monitor how this pattern changes over time given the trend in KT12 and everywhere else to use more public transport and healthier options.

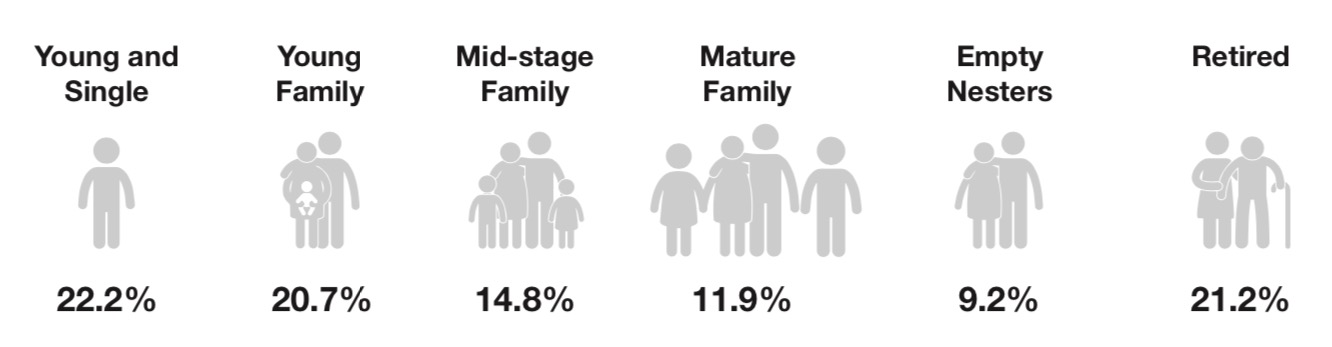

Lifecycle mix in Walton on Thames and Hersham:

Where people are in their lifecycles can be a real indicator of the character of the local area. In Walton on Thames and Hersham, the lifecycle mix of residents can be split into the following six categories:

If you are interested in purchasing your first, second or umpteenth buy-to-let, please visit our office for a friendly chat so we can give you the inside track and lowdown on being a landlord in KT12 today.

Source: ResiAnalytics, Office for National Statistics and Land Registry © Crown copyright 2016. Note: Dotted lines indicate estimates based on historical patterns.